- What is the 4 Percent Rule for Retirement?

- The 4 Percent Rule for Retirement Withdrawals: A Brief History

- Does the 4% Rule Still Work? Should You Use the 4 Percent Rule to Generate Retirement Income?

- The 4 Percent Rule for Retirement: Other Nuances and Considerations

- Conclusion and Our Approach

- Alternatives and Alterations to the 4% Rule

- Frequently Asked Questions (FAQs)

- Q: What is the 4 percent rule for retirement withdrawals?

- Q: How does the 4% rule work? How is the 4 percent rule calculated?

- Q: How long will my money last using the 4% rule?

- Q: Why is the 4% rule outdated?

- Q: What is the impact of social security income on the 4 percent rule?

- Q: What is the impact of rental income on the 4% rule?

- Q: What is the impact of dividends on the 4% rule?

- Q: What is the impact of taxes on the calculations of the 4 percent rule?

What is the 4 Percent Rule for Retirement?

One of the biggest concerns for people wanting to retire is to find out how much they can spend every month without running out of money, based on how much they have saved.

Conversely, they want to know how much they would need to save so that they can spend their desired amount in retirement.

The 4 Percent Rule is commonly used as a rule of thumb to answer these questions.

The 4 Percent Rule: You can spend 4% of your portfolio each year in retirement.

Simply put, you can spend 4% of your portfolio value every year without worrying about running out of money in retirement (this is also called the “safe withdrawal rate”). For example, if you retire with $1 million, you can spend $40,000 each year.

Conversely, the 4 Percent Rule can be used to calculate how much money you need to save for retirement.

The 4 Percent Rule: You can retire when you have saved up 25 times your yearly expenses.

So, once you have saved up 25x your annual spending, you can retire without worrying about running out of money. For example, if you plan to spend $60,000 per year in retirement, you will need $1.5 million in your retirement savings.

But the 4 Percent Rule is much more nuanced, with several assumptions and caveats. Read on for complete details!

The 4 Percent Rule for Retirement Withdrawals: A Brief History

To be honest, the 4% rule is not really a rule – it’s more a conclusion based on the research conducted by a financial advisor named Bill Bengen. He studied the historical data on stock & bond returns and inflation from 1926 to 1992.

Based on this study, published a paper in 1994 which concluded that if someone withdrew 4% of their portfolio in the first year of retirement and adjusted it for inflation in the subsequent years, they would not run out of money during a 30-year retirement under any economic scenario.

Yes, that’s right: under any economic scenario, which included the crash of 1929 and the stagflation of the 1970s!

And thus, the “4 percent rule for retirement” was born.

Does the 4% Rule Still Work? Should You Use the 4 Percent Rule to Generate Retirement Income?

Since the 4% rule has become popular as a rule of thumb, it’s simple to say “you can spend 4% of your portfolio each year in retirement”. But is it true for everyone, under all circumstances?

Not really! There are certain conditions and assumptions based on which Bill Bengen derived the results that have now become popular as the 4% rule. So, the rule is valid only under those circumstances!

Here are the details, and a detailed analysis of whether you should be using the 4% rule any more.

Retirement time frame of 30 years

The study assumed someone retiring at age 65 and living till age 95. So, the rule covers utilizing the retirement savings for up to 30 years.

But what if you’re retiring at age 62, and live till 100? What if you retire early at 55, and live till 95?

If your time in retirement is likely to be more than 30 years, you cannot use the 4% rule as-is!

Specific asset allocation

The study assumed a 50:50 asset allocation – 50% in stocks, and 50% in bonds.

While this is a fair assumption, not everyone follows a 50:50 allocation. And any deviation from the 50:50 asset allocation means you cannot blindly follow the 4% rule.

Your exact asset allocation post-retirement depends on your specific situation: your age, life expectancy, total retirement savings, expected yearly expanses, risk tolerance, and other income like rent, dividends, social security withdrawals, pension, etc.

Bottomline, if your asset allocation is not 50% stocks and 50% bonds, you cannot use the 4% rule as-is!

Constant spending

The study by Bill Bengen assumed that the spending in retirement remains constant: you would spend the exact same amount every year (adjusted for inflation each subsequent year).

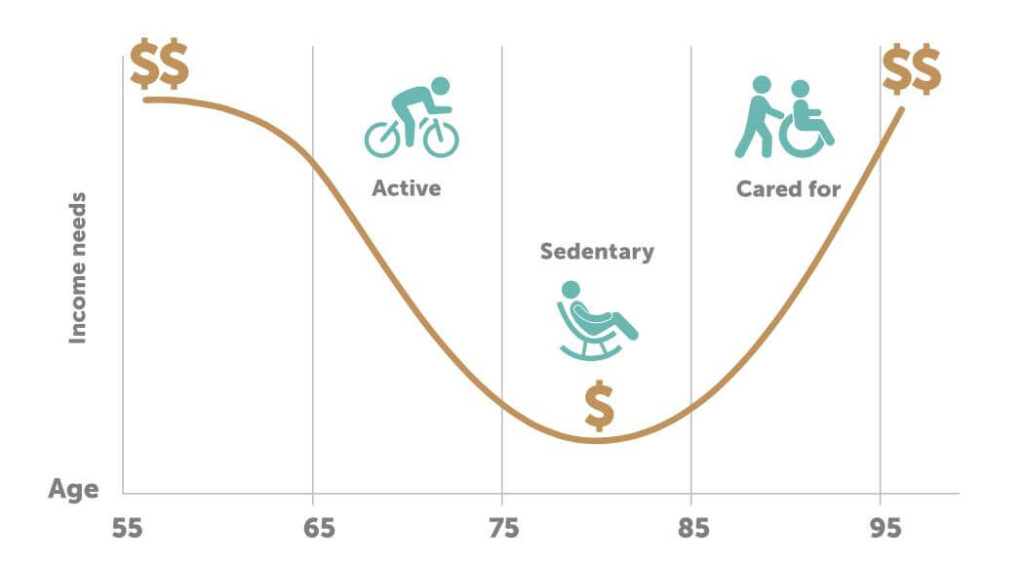

But this is not true for most people. Our spending after retirement follows a typical pattern, often called the “retirement smile”:

- Go-Go Years: The initial few years are when we are at our healthiest and want to use the time to its fullest – this is when most retired people travel or eat out the most. This is typically till age 75. The spending during this go-go period is high.

- Slow-Go Years: This is the time when we start to see health deteriorate, making strenuous activities like travel less feasible. We still enjoy some travel, but it slows down. This is typically from age 75 to 85. The spending during this slow-go period reduces significantly.

- No-Go Years: This is the time when we can’t do much more than basic daily activities. Health deteriorates, and healthcare expenses shoot up. This is the time when there could also be expenses related to nursing homes. This is typically after age 85. The spending during this no-go period is high.

Since your spending is highly likely to follow this “retirement smile” and would not be the exact same throughout your life, the 4% rule is not very practical to use in real life.

No course correction or intervention

This one follows from the above point. The safe withdrawal rate of 4% is based on constant spending in all years. But even if we disregard the retirement smile, would we want to spend the same amount every year irrespective of how our investments perform?

I don’t think so! I believe most of us would tweak our spending to some extent to reflect the returns we receive from the market. For example, I would postpone a vacation by a year or two if the stock market is down 15% that year.

Because the 4% rule doesn’t consider such simple tweaks, it’s recommended safe withdrawal rate of 4% could be on the conservative side for many people.

Based on past data

It is important to note that the conclusions of the 4 percent rule for retirement are based on an analysis of historic data (like returns from stocks and bonds, inflation, etc.)

Like past performance is not a guarantee of future performance for mutual funds, there is no guarantee that the future will turn out to be the same when it comes to retirement withdrawals!

However, considering the extended length of past data considered, we can be reasonably sure that the conclusions of the 4% rule will hold true in the future – of course, limited by its considerations (30 years retirement period, 50:50 asset allocation, etc.)

Covers sequence of returns risk

One important thing to note is that the 4% rule does consider the sequence of returns risk, which is the risk that a negative return in the initial few years of retirement could completely derail your retirement.

The safe withdrawal rate of 4% is after considering all the sequences of returns in the period of study by Bill Bengen, including many periods with negative returns in the first few years of a 30-year retirement.

The 4 Percent Rule for Retirement: Other Nuances and Considerations

4% Withdrawal rate only for the first year

The 4 percent rule for retirement recommends the 4% withdrawal rate only for the first year in retirement. For all subsequent years, the withdrawal amount will be the previous year’s amount adjusted for inflation – irrespective of the performance of your investments.

The withdrawal rate is not 4% of portfolio for all years in retirement – the withdrawal rate will vary depending on the returns you get on you investment.

Here’s a detailed example to illustrate this.

| Year | Portfolio Value | Actual Withdrawal Amount | Withdrawal Rate | Amount Post Withdrawal | Market Return | Inflation |

|---|---|---|---|---|---|---|

| 1 | $1,500,000 | $60,000 | 4.0% | $1,440,000 | 15% | 3.0% |

| 2 | $1,656,000 | $61,800 | 3.7% | $1,594,200 | 20% | 3.5% |

| 3 | $1,913,040 | $63,963 | 3.3% | $1,849,077 | -10% | 2.5% |

| 4 | $1,664,169 | $65,562 | 3.9% | $1,598,607 | -10% | 2.0% |

| 5 | $1,438,747 | $66,873 | 4.6% | $1,371,873 | 25% | 2.5% |

| 6 | $1,714,841 | $68,545 | 4.0% | $1,646,296 | 15% | 3.0% |

| 7 | $1,893,241 | $70,602 | 3.7% | $1,822,639 | 10% | 3.0% |

| 8 | $2,004,903 | $72,720 | 3.6% | $1,932,184 | -15% | 3.5% |

| 9 | $1,642,356 | $75,265 | 4.6% | $1,567,091 | 5% | 3.0% |

| 10 | $1,645,446 | $77,523 | 4.7% | $1,567,923 | 5% | 3.0% |

Let’s discuss the withdrawals in years 1 and 2 to understand this better.

Retirement is starting in year 1. Therefore, based on the 4% rule, the withdrawal rate for year 1 is 4%. So, the withdrawal amount is 4% of $1,500,000, which is $60,000.

The 4% rule says that the withdrawal amount in year 2 = inflation adjusted amount in year 1.

The inflation in year 1 is 3%, so the withdrawal amount for year 2 is $61,800, which is 3% more than year 1. Since the starting portfolio for year 2 is $1,656,000 (after a 15% return on the post-withdrawal portfolio of $1,440,000), the effective withdrawal rate turns out to be 3.7% ($61,800 is 3.7% of $1,656,000).

Note: The fact that the 4% rule adjusts your spending based on inflation every year is a major positive of this rule. This ensures that your standard of living doesn’t take a hit in the years in which the market doesn’t perform well.

The 4 percent rule and social security withdrawals

The 4% rule tells you how much you can withdraw from your retirement savings – purely based on the size of your retirement savings, and nothing else.

So, irrespective of whether you are taking social security withdrawals or not, the rule says you can withdraw 4% of your portfolio.

Any amount you receive from social security will be on top of the 4% withdrawal. If you don’t need that much money to spend, you can of course reduce the withdrawal from your retirement savings.

Example: Your yearly expenses are $60,000. Your retirement saving is $1.5 million. The 4% rule says you can withdraw 4 percent of $1.5 million, or $60,000. You also receive social security payment of $20,000.

In this case, you can:

- Increase your spending to $80,000 ($60,000 withdrawal plus $20,000 social security payment), or

- Withdraw only $40,000 from your retirement portfolio ($60,000 possible withdrawal less $20,000 social security payment)

The 4 percent rule and dividends

This is the same as above: irrespective of whether your investments earn any dividends or not, the rule says you can withdraw 4% of your portfolio. Any amount you receive from dividends will be on top of the 4% withdrawal.

So, you can either increase your spending or reduce the withdrawal from your retirement savings.

The 4 percent rule and rent

Again, same as above: if you have any income in the form of rent payments, you can either increase your spending or reduce the withdrawal from your retirement savings.

The 4 percent rule and taxes (withdrawals from tax deferred vs taxable accounts)

The 4% rule is also agnostic of the tax status of the withdrawals.

So, the withdrawal amount remains the same irrespective of whether a retiree is withdrawing from a tax deferred account (like 401k or IRA), tax free account (like Roth IRA and Roth 401k), or a taxable account (like a brokerage account).

However, the amount you actually get to spend will get reduced by the amount of tax you pay on the withdrawal.

Example

Let’s go back to our example: Your retirement saving is $1.5 million, and the 4% rule says you can withdraw 4% of $1.5 million, or $60,000.

- Withdraw $60,000 from a Roth IRA: This is a tax-free account, so you will pay no taxes and get to spend the entire $60,000.

- Withdraw $60,000 from a 401k account: This is a tax deferred account. If your tax rate is 24%, you will pay $14,400 in taxes, and will get to spend only $45,600 ($60,000 less $14,400 tax paid).

- Withdraw $60,000 from a brokerage account: This is a taxable account. If your capital gains rate is 15%, you will pay $9,000 in taxes, and will get to spend only $51,000 ($60,000 less $9,000 tax paid).

Conclusion and Our Approach

So, what is the conclusion? Does the 4% rule still work?

Should you be using the 4 percent rule of retirement?

Here’s my take: it is a good starting point if you’re just starting to think about retirement. It gives you a ballpark, something to start with.

Then you analyze your situation in detail (expected expenses, social security income, dividend income, rental income, pensions, healthcare costs, etc.) to get a more accurate estimate of the amount you need to save up before you can retire.

Did we use the 4% rule for our retirement planning?

Yes, and no!

When we first started thinking about retirement in 2023, we used the 4% rule to see whether an early retirement was even remotely feasible. When it looked like it was, we continued our analysis.

Since we are looking at an early retirement (around age 49), our retirement is expected to last way longer than the 30 years supported by the 4% rule.Remember, the longer the time you spend in retirement, the more are the uncertainties around market performance, inflation, healthcare costs, the state of social security, etc.

Therefore, we decided to be conservative and applied a haircut: we decided that a more appropriate safe withdrawal rate in our case would be 3%. And when it appeared that a 3% withdrawal rate was likely to be feasible for us, we started a deeper study and analysis.

Here are some of the tools we used:

- The Safe Withdrawal Rate Series by Karsten Jeske, a.k.a. Big Ern

- New Retirement, an in-depth retirement planning software that includes Monte Carlo simulations (paid)

- Projection Lab, another in-depth retirement planning software that uses ramdomized historic data to simulate your retirement (paid)

- cFIREsim, yet another tool to simulate your retirement (free)

- FI Calc, a calculator that evaluates your retirement plan using historical data (free)

- Honest Math, a retirement simulator (free)

Alternatives and Alterations to the 4% Rule

Here are some alternatives to determine the safe withdrawal rate for your retirement, or to find out how much you need before you can retire:

- The bucket strategy

- Dynamic withdrawal strategies, like Guyton-Klinger Guardrails

- Schiller Cyclically Adjusted Price to Earnings (CAPE) ratio based withdrawal rules

- Spending based on the Required Minimum Distribution (RMD) formula

Frequently Asked Questions (FAQs)

Q: What is the 4 percent rule for retirement withdrawals?

A: In simple terms, it states that if you withdraw 4% of your retirement savings in the first year of your retirement, and adjust it for inflation each subsequent year, you would not run out of money for at least 30 years in retirement.

Q: How does the 4% rule work? How is the 4 percent rule calculated?

A: The amount you can spend as a retiree in the first year of retirement is 4% of your portfolio. So, if the amount you have saved is $800,000, you can spend 4% of it, or $32,000.

Alternatively, the 4 percent rule tells you how much you need to save for a specific level of spending: amount needed = 25 times the yearly spending. So, if you plan to spend $50,000 per year, the amount you need to save for retirement is 25 x $50,000 = $1,250,000.

Q: How long will my money last using the 4% rule?

A: The 4% rule assure that your money would last for at least 30 years into retirement.

Q: Why is the 4% rule outdated?

A: The rule is not necessarily outdated, but the result of this rule may need to be tweaked because the current economic environment is different from that of the period of the study by Bill Bengen.

The result should also be tweaked based on your specific financial and health circumstances (changes in planned expenses over the years, tax situation, your goals related to charitable donations or providing inheritance, family medical history, etc.)

Q: What is the impact of social security income on the 4 percent rule?

A: The 4% rule does not consider social security withdrawals. Any amount you receive from social security will be on top of the withdrawals based on the 4% rule.

If you don’t need that much money to spend, you can reduce the withdrawal from your retirement savings.

Q: What is the impact of rental income on the 4% rule?

A: The 4% rule does not consider any rental income. Any rent you receive will be on top of the withdrawals based on the 4% rule.

If you don’t need that much money to spend, you can reduce the withdrawal from your retirement savings.

Q: What is the impact of dividends on the 4% rule?

A: The 4% rule does not consider dividend income. Any dividends you receive will be on top of the withdrawals based on the 4% rule.

If you don’t need that much money to spend, you can reduce the withdrawal from your retirement savings.

Q: What is the impact of taxes on the calculations of the 4 percent rule?

A: The 4% rule does not consider taxes, or whether the withdrawal is from tax deferred or taxable accounts.

Based on where you take the money from, you may have to pay taxes and the amount you actually get to spend will get reduced by the amount of tax you pay.